Children, ages 0-12 can open Sparky’s youth savings account and enjoy perks just for kids including:

- Sparky’s newsletter (ages 4-12), filled with activities, games, savings tips, a coloring contest, and more!

- A birthday card from Sparky.

- A chance to dig into Sparky’s “treat jar” filled with goodies when they visit any branch

- The opportunity to adopt Smokey, the piggy bank.

- Prizes and games with Sparky’s Kids Club (ages 5-12).

Smokey, the Piggy Bank

When kids join FFCCU, they can adopt Smokey the piggy bank to help them along on their savings journey.

Giving kids the knowledge and tools to develop smart money habits at an early age sets them up for greater financial success later in life. Sparky’s Kids Club rewards kids, ages 5-12, for completing financial education activities or starting smart financial habits.

Here’s how it works:

- Kids receive an age-appropriate activity book filled with financial education activities, and an activity tracker to chart their progress.

- Kids complete financial education activities and record them on the tracking sheet. There is no limit on the number of activities a child can complete.

- Once they’ve completed enough activities to earn a prize, kids can bring their activity tracker into a branch and swap it for a prize and a new activity sheet and start the process over again.

PLUS, Sparky’s Kids Club Newsletter, which kids receive each quarter, is filled with more opportunities to help fill their activity tracker.

Here’s What Sparky’s Kids Club Members Receive.

SPARKY'S

ACTIVITY TRACKER

SPARKY'S

ACTIVITY BOOK (AGES 5-8)

SPARKY'S ACTIVITY BOOK (AGES 9-12)

SPARKY'S

PRIZE SHEET

CURRENT

NEWSLETTER

How Do Kids Savings Accounts Teach Financial Literacy?

Long before your child has their first job, money is already a big part of their life. From trips to the grocery store for essentials to visits to the local movie theater for family time, kids see the adults in their lives spending money every day. What children don’t always see – or understand — is what’s happening to earn and save that money, an important aspect of teaching kids about money.

That’s why youth savings accounts are important. Whether your child is still riding in the front of the shopping cart or starting to go to movies with their friends, there’s an opportunity to teach them about the value of every dollar they spend.

Discussions about financial literacy aren’t always easy, but they are important. One of the biggest ways children at all ages learn about money is by watching their parents and hearing about the financial decisions they make. The next biggest way is by DOING – having their own money, learning how to save, and actively participating in decisions on when to spend or donate. This early exposure to decision making builds not only financial independence but also financial confidence. The best kids savings accounts are a big part of this learning.

Is the stuffed animal worth it? What about v-bucks for their video game?

When your child receives money for their birthday or another special occasion, where does it go? How do they earn money? By opening a kids savings account with these funds and encouraging your child to find ways to earn, you child can track how much money they have and where they’re spending it. They can also set goals to start saving for something special, such as laying the groundwork for future financial goals.

With Sparky’s Kids Club, we couple saving money with learning activities that teach children about smart financial habits and help them become money smart from an early age. It’s not just a kids savings account: it’s a learning tool built around kids’ needs at every age. Your child can practice shopping, think about their savings goals and more. It’s a big first step in setting your child up for financial success for the rest of their life

KUDOS!

My experience with FFCCU’s Parma branch has been nothing but positive. Obtaining an auto loan was really easy, even though I came to the establishment as a nonmember.

-Star B.

Whenever I have questions and start a chat I always receive a quick response with all my questions thoroughly answered. Just wanted to say THANK YOU!

-Jerry T.

I love FFCCU! All of the convenience of a big bank with more personalized service. Friendly and helpful staff. A great financial partner! And I love how the credit union is member owned.

Rachel

Fortunately, we found out about the mortgage program at FFCCU. We had originally applied for a loan through a bank, but they were not interested in helping us. FFCCU put through our loan in a timely m...

-John B.

Erica Irons went above and beyond for our home loan! In spite of storm damage causing our branch to close, she made our transaction smooth. I love FFCCU in Willoughby ❤️

Mary Kay & Joe

Jovan, Bev, Jenny, and the other personnel at the Wellington branch are absolutely Rock Stars. They have always been so helpful, they are the greatest 😊

Sue S.

I would like to thank Meghan T., for taking her time with a loan we needed. We were nervous about coming in, but she was very thorough and helpful. Words can’t express how appreciated we felt!

-Alice & James D.

I experienced a problem with an automatic withdrawal. Emily provided lots of information on how to handle it and secured a refund. More than that: she gave me moral support, when I was feeling very up...

Irene

Beth was great to work with! Super responsive. The entire process was so smooth and easy!

-Brooke G.

I work with banks and credit unions on a daily basis, and FFCCU goes above and beyond to help its members. Thank you all for making the process easy to understand and treating me like a person.

-Jennifer

Our family has benefited from over 30 years of outstanding service with Firefighters Community Credit Union. Thanks for the prompt response to my online live chat question.

-Jeffery K.

I’d had a poor experience with a previous lender, but took a chance and reached out to FFCCU. I am so happy I went with them and got locked in on a rate I was flabbergasted by. I’m switchi...

-Brian W.

Sparky's Kids Club Rates

As of April 29, 2025

| Account Name | Min. Balance | APY* |

|---|---|---|

| Sparky's Club Savings-Youth Account | $5+ | 0.01% |

*APY = Annual Percentage Yield. Dividends are credited to your account and compounded every month. Minimum balance requirements apply to average daily balance to earn dividends.*Click here to view full rate disclosures and policies. Call 800.621.4644 for current rates as they are subject to change at any time and without notice.

Youth Savings FAQs

SETTING UP AN ACCOUNT

You can open an account online, but you will need to provide identification verification the next time you visit one of our branches.

Nope! We want your child to learn how to save and make the most of their money, which is why we never charge fees, including monthly maintenance fees, for our youth savings account.

We know that young savers learn best when they start small. That’s why our kids’ savings account has only a $5 minimum balance requirement.

Parents or legal guardians will need to bring in two forms of ID for themselves. You will also need to bring in your child’s birth certificate and social security card.

Our kids savings account pays dividends, which are credited to your account every month. We calculate dividends using APY (Annual Percentage Yield). While you only need a $5 minimum in your account to maintain it, you’ll only earn dividends when your minimum average daily balance is $50.

ACCOUNT CONTROL

Visit us at a branch or ATM. Our kids savings account works just like traditional bank accounts, giving you quick access to your money and enabling various types of transactions.

Yes – in fact, it’s required. A parent or guardian must be a joint owner on any account for an individual who is younger than 18 years of age. As joint account holders, the adult will have access to the child’s account, ensuring that the parent, as the primary account owner, retains exclusive control of the account. This includes online banking and the mobile banking app access.

Absolutely, as long as you’re listed as the joint account holder, giving you full access to our online banking services.

Absolutely! As kids get older their financial needs and financial independence changes. When your child turns 13, we recommend transitioning them to our Club Ignite program. It’s exclusively for 13- to 18-year-olds, and includes a savings account, a checking account and debit card. Parents can setup parental controls while allowing their kids more financial freedom. Visit our Club Ignite page to learn more.

SPARKY’S KIDS CLUB ACTIVITIES

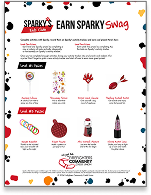

We help your child learn about saving and money while they earn prizes! Our reward system is kid-friendly and easy to take advantage of:

- Kids will receive an age-appropriate activity book filled with financial education activities and an activity tracker.

- Every time your child completes an activity, have them record it on their tracker.

- Once they’ve completed enough activities to earn a prize, bring their activity tracker into a branch. You’ll receive a prize as well as a new activity sheet.

- Every quarter, you’ll receive a copy of Sparky’s Kids Club Newsletter. It will have more opportunities to help kids complete their activity tracker.

Workbooks and newsletters, which are mailed to you, will include activities you can complete at home. Once you’ve earned enough for a prize, you’ll need to visit a branch to turn in your child’s activity tracker. If extenuating circumstances prohibit you from visiting a branch, please call us at 216.621.4644, and we can help make alternative arrangements.

The more the better! There is no limit to the number of activities your child can participate in.